Yes, space is still a GREAT investment sector, but tread carefully

Learn what makes space an interesting area for VC investment and how Sunil has shifted this thinking over the last 10 years of space investing.

This morning, SpaceNews just released their video interview with Sunil Nagaraj.

In this 19-minute video interview, Sunil covers the following:

What kicked off his interest in commercial space investing — going back to 2010 (0:54)

Sunil’s huge mistake in thinking “astronomy” was the same as “commercial space” (1:36)

Sunil’s first pitch meeting with Rocket Lab CEO Peter Beck in late 2014 while at Bessemer (2:15) - RKLB is now a public company with a $13B market capitalization. View the full Bessemer Investment Memo for Rocket Lab from October 2014.

How space investing looks more like tech investing (3:44): lower cost experimentation, buyers of finished products vs. signing a development contract, a rich ecosystem of downstream and upstream investors, lower capital requirements — space was becoming more software like.

How the space investment landscape has changed over the last decade — the rapidly swinging pendulum of VC interest (4:39)

How Rocket Lab’s engine inspired “software beyond the screen” (7:25)- with flexible, updatable, changeable software inside the core of Rocket Lab’s Rutherford engine and its electric turbopump.

How AI is being utilized by space startups (9:45) - including Ubiquity’s portfolio companies Loft Orbital and Muon Space. AI enables space assets to make decisions autonomously, utilize downlink bandwidth more efficiently, and more.

The biggest challenges space startups face when raising VC today (12:20) - it’s all about the deeptech entrepreneurship tension between “Look What I Can Do” vs. “Look Who Cares”, shifting the focus from solution architecture and technical accomplishment to customer impact.

Breaking down the sub-segments of commercial space to invest in (16:09)

Click below to listen/watch to this latest episode of SpaceNews Commercial Space Transformers.

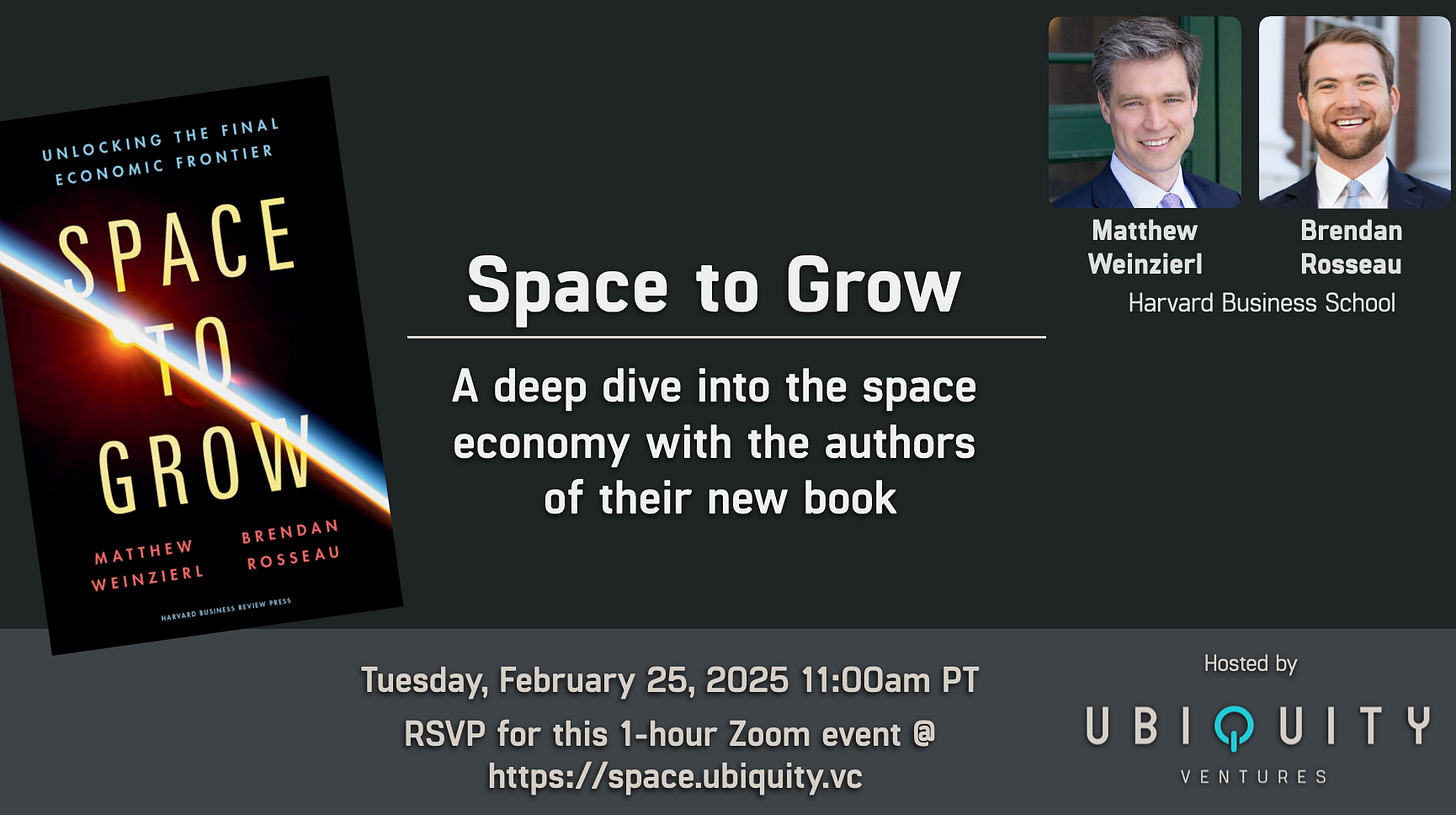

Keep learning at our February 25 Ubiquity space event next week

If you want to learn more, register for our Ubiquity Ventures event with Harvard's Matthew Weinzierl and Brendan Rosseau sharing their tech on opportunities in the commercial space area -- "Space to Grow: a deep dive into the space economy with the authors of their new book" -- next Wednesday, February 2/25 morning - a free public event: Register now at https://www.ubqt.vc/p/youre-invited-space-to-grow-hbs

Ubiquity Ventures — led by Sunil Nagaraj — is a seed-stage venture capital firm focused on startups solving real-world physical problems with "software beyond the screen", often using smart hardware or machine learning.

If your startup fits this description, fill out the 60-second Ubiquity pitch form and you’ll hear back within 24 hours.