"The 5 Main VC Financing Docs Explained" & "Cap Table 101": our 2 newest Ubiquity University modules

Use these short 10-minute videos from Ubiquity University to understand the philosophy and tactics of these critical startup financing documents/tools.

Today we’re excited to announce the addition of 2 important modules to our “Day One” series on Ubiquity University:

“The 5 VC Financing Documents: What You Really Need to Know” with Ivan Gaviria of Gunderson Dettmer

“Cap Table 101: How to Build One from Scratch” with Sunil Nagaraj

Ubiquity University is our free resource to share the latest knowledge and advice for pre-seed, seed, and Series A stage entrepreneurs. We create short 5-15 minute videos that dive into key concepts, mindset shifts, and tactical advice to help startup leaders grow and develop. Our speakers include the sharpest technical and business experts from the Ubiquity Extended Team and beyond.

The 5 VC Financing Documents: What You Really Need to Know

For startup leaders who just raised their first round of venture capital, we have Ubiquity University’s “Day One” series. Our newest module features Ivan Gaviria, who runs the San Francisco and Silicon Valley offices of VC-focused law firm Gunderson Dettmer, the most active VC-focused law firm in the world. Ivan takes us through the 5 main legal documents behind a standard venture capital financing:

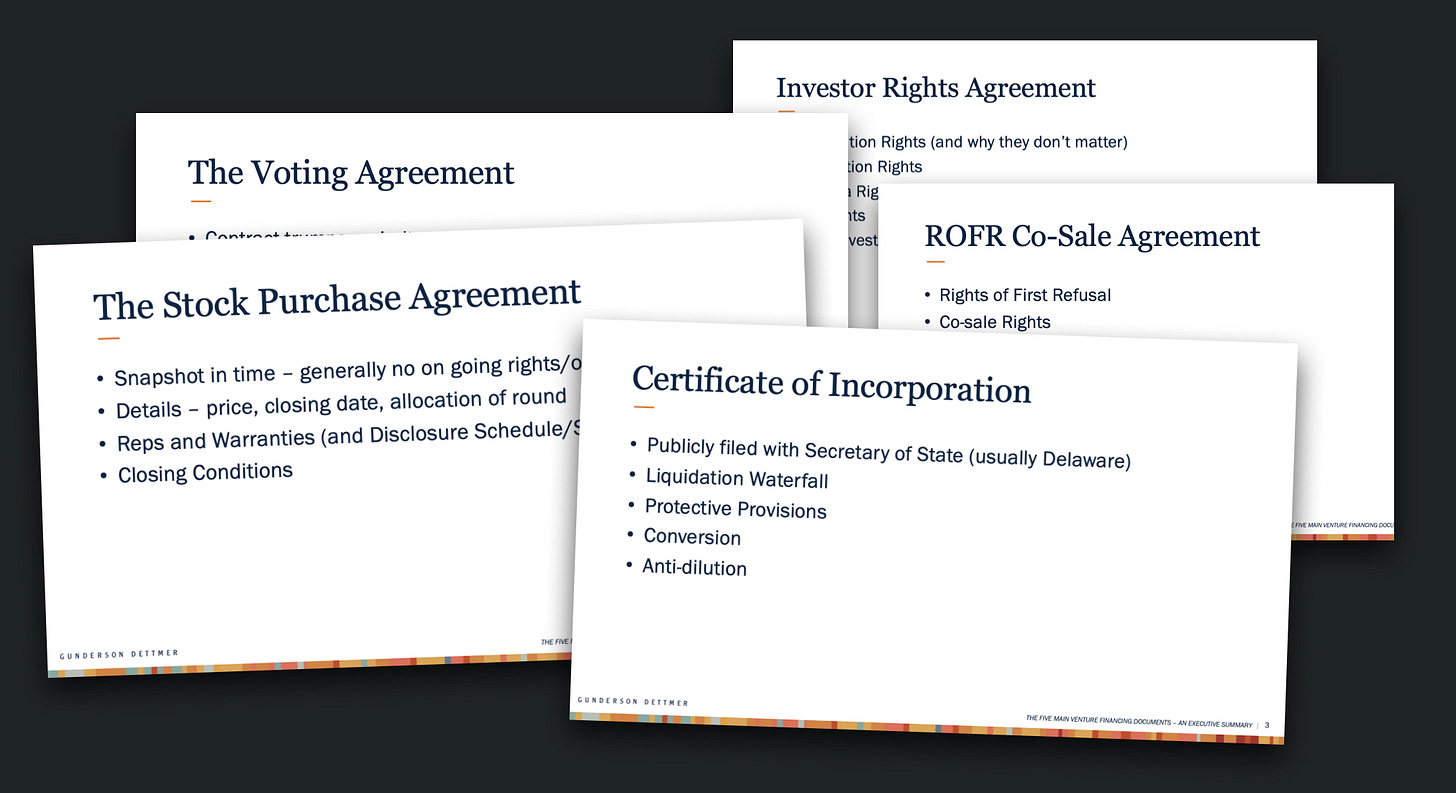

Stock Purchase Agreement

Certificate of Incorporation/Charter

Investor Rights Agreement

Voting Agreement

Right of First Refusal & Co-Sale Agreement

In this 20-minute video, Ivan captures the purpose of each document, tactical details, and common watchouts. Watch “The 5 VC Financing Documents: What you Really Need to Know” on Ubiquity University.

Cap Table 101: How to Build One from Scratch

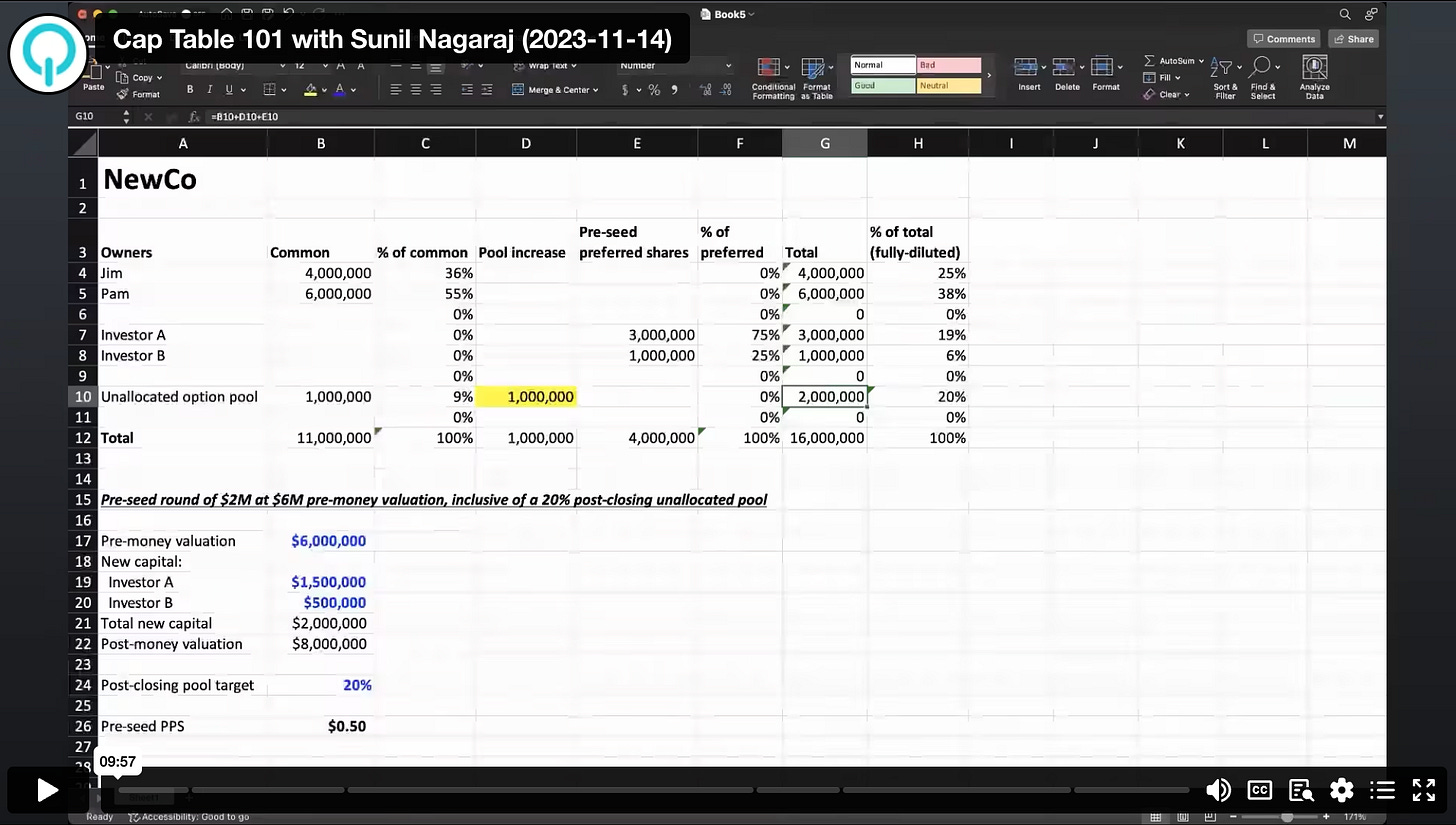

In this session, Sunil Nagaraj explains how startup cap tables work. He starts with a blank Excel sheet and builds up a new startup's capitalization table ("cap table"). It begins with 2 co-founders with an initial option pool, then we model in a pre-seed financing and increase the unallocated pool accordingly. Watch this 9-minute video now on Ubiquity University.

The Rest of the “Day One” Series

The 6 videos that comprise the Day One Series are for entrepreneurs who are raising or just raised their first round of capital. Topics cover Nailing the Mindset for your First Board Meeting, Setting Up your First Basic Financial Model (including a Google Sheets template you can use), Managing Early Customer Development and more.

Ubiquity Ventures — led by Sunil Nagaraj — is a seed-stage venture capital firm focused on startups solving real-world physical problems with "software beyond the screen", often using smart hardware or machine learning.

If your startup fits this description, fill out the 60-second Ubiquity pitch form and you’ll hear back soon.