Ubiquity CEO Profile: Adam Price of Kinetic (injury reduction platform for the frontline workforce)

Learn how Kinetic CEO expanded beyond their smart hardware-powered injury prevention product into injury prediction/management to spur massive growth.

Today we spotlight a CEO who leverages software beyond the screen to transform an industry. As always, each Ubiquity CEO has their own nerdy background (we define nerdiness as having a deep obsession) that we love exploring.

Meet Adam Price, CEO of Kinetic, provider of wearable technology and tech-driven, proactive workers' compensation insurance to help reduce injuries among the industrial workforce.

Can you sum up what Kinetic does in one sentence?

Kinetic provides a tech-centric injury reduction platform to help lower injuries in the frontline workforce.

Tell us more about Kinetic’s platform.

Kinetic’s platform consists of various products, all with a focus on one of three core areas. We view workforce safety in three pillars:

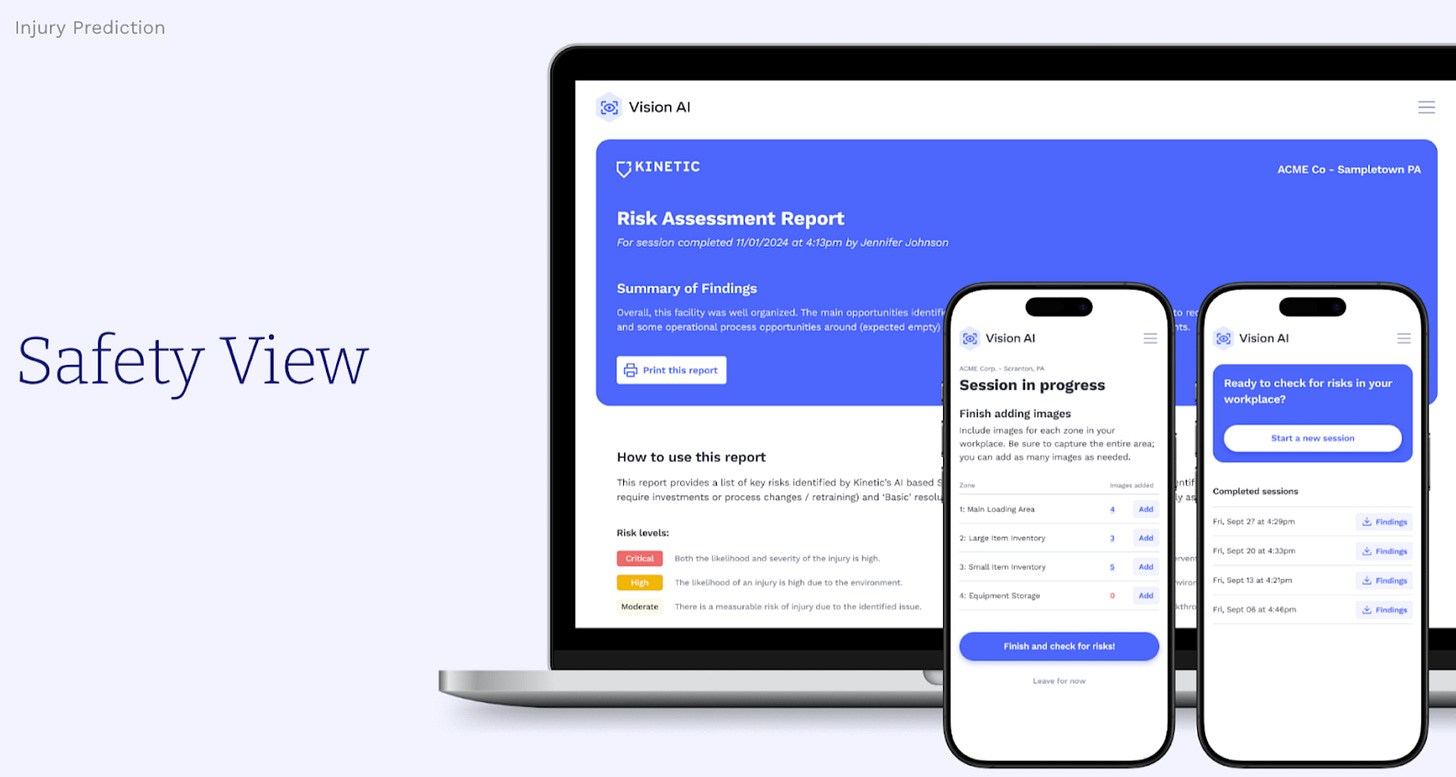

Injury prediction

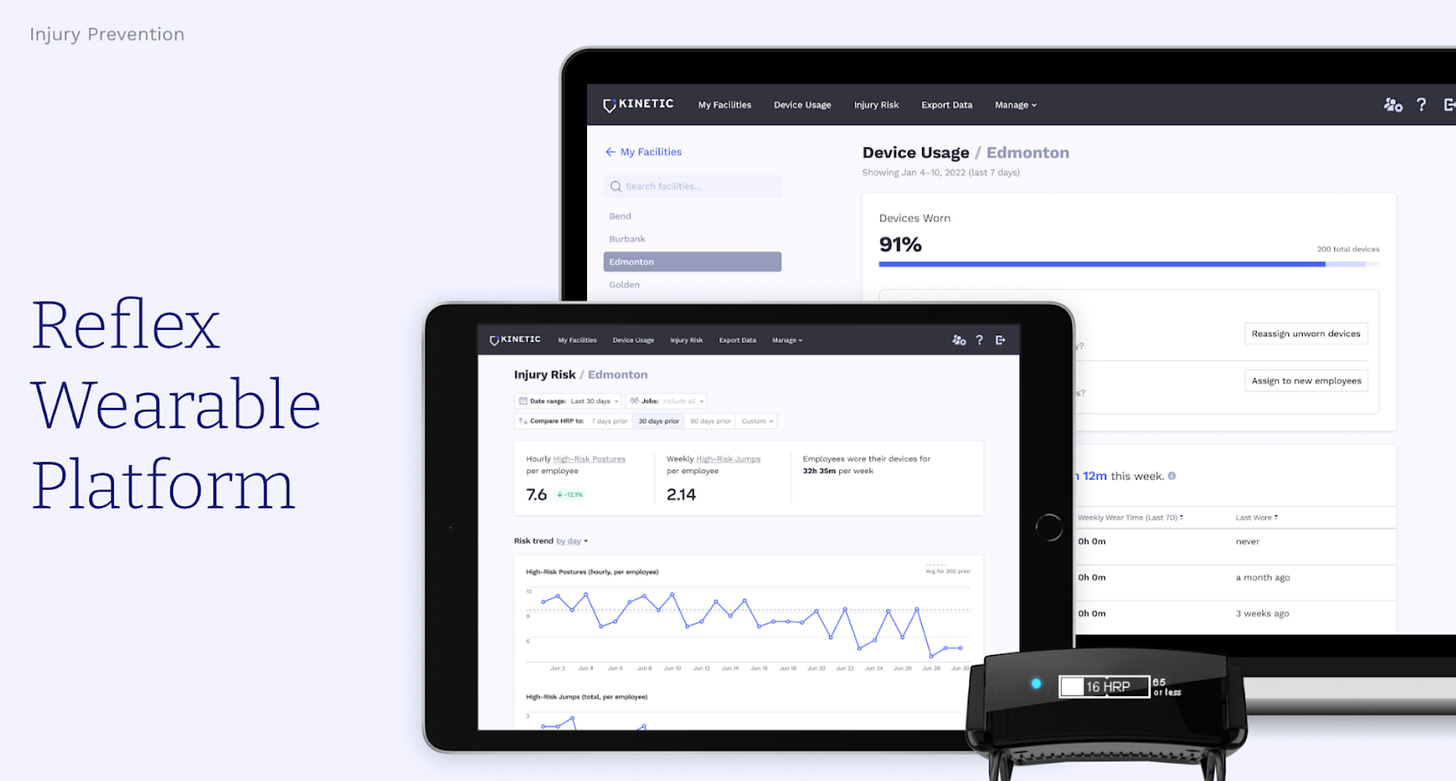

Injury prevention

Injury management

Together, these three pillars holistically cover on-the-job safety challenges for employees and employers.

What failed attempts did you/your team try before getting to the current solution?

I’d say it was more of a lack of innovation beyond our first product. Kinetic started years with a great first product: a wearable device designed to reduce strain and sprain injuries, which are common in the frontline workforce. But what we didn't acknowledge early enough in our business was that on-the-job safety is more holistic than just “injury prevention” and preventing a single type of injury. Our device addressed only a small piece of the puzzle, and we weren't really providing enough value to our customers or approaching the market in the right way to get our product into their hands.

It wasn't until we decided to innovate in the other two areas – injury prediction and injury management – that we began to see real growth at Kinetic. By thinking more holistically about our customers’ needs, both in terms of necessity and desire, we were able to better solve their challenges. That was a big lesson learned in our business. We simply weren't innovating enough; we were complacent with a single myopic focus on a very useful product, but the product wasn't big enough to solve the problems that our customers truly had.

What signals have you seen that customers love your product?

Rapid growth in our business has been a big signal. On the insurance side, we've gone from no insurance customers to over 430 policy holders in less than three years. In the same time, we’ve grown from no insurance premium written to about $75 million premium written.

Alongside the rapid growth, we're seeing a lot of resonance and love of our products, reflected in customer testimonials. We regularly engage with our policy holders about how the products are working. Customers frequently rave about using the products and the impacts they've had, including the cost savings on premiums and improved safety within their workforce.

We think of nerds as people who are obsessed with something. What are you nerdy about or obsessed with both inside and outside of work?

I'm pretty nerdy and obsessive about data and analysis. My background is in aerospace engineering, so I've always been pretty data-driven, but I'm also very careful about avoiding analysis paralysis. I think that's come through in a lot of the actions we've taken as a business.

Outside of work, I even build spreadsheets for my personal life. Inside of work, we’ve tried to make our team equally obsessive about using data to drive decisions. A prime example of this is our bi-weekly leadership team strategy meetings. These are two-hours sessions, and data intensive pre-reads are required going into each meeting. If someone has an idea for a new product or initiative, they really have to mine through our Tableau or Salesforce data to pull together a story that supports what they want to drive. We don't really let people shoot from the hip inside the business, and I think this has helped us move in the right direction and make very insightful decisions about the business.

Outside of data, I'm also pretty obsessive about being active; I have a Peloton and I’m extremely competitive on that. And I love historical nonfiction.

What would you tell your past self if you could give them advice?

I love entrepreneurship, and I've had that bug since high school. The idea of starting a business, selling something and generating profit has always excited me.

Looking back, I think my younger self was eager to jump into starting a business, regardless of whether it was really viable. Now that I've been at several startups, I’ve seen the difference between startups that do really well and those that don’t. My advice to my past self would be to get comfortable with recognizing when you don’t have product-market fit.

There’s a strong tendency among entrepreneurs – and myself – to grit their way through the growth, even if they’re pushing more than the customers are pulling. In hindsight, I would have benefitted from stepping back sooner when a product or idea didn’t align with market needs, rather than trying to force a boulder uphill. When you have product-market fit, the business just takes off, and you're trying to keep the wheels on the bus while it’s moving at 100 miles per hour.

What’s your advice to budding technical founders who haven’t yet taken the leap to launch their new company?

Ubiquity is a wonderful venture capital investor of ours, but one piece of advice I always give to anyone considering starting a technology company is: many of the best founders may not need to raise money. They may have a product or idea strong enough to get off the ground and quickly achieve a profitable model, without needing outside capital.

Of course, there are exceptions – especially in deep tech, where significant capital is needed to get a product off the ground. But I strongly encourage potential founders to try and launch their business without relying on millions of dollars in capital. This approach helps founders take baby steps to validate product-market fit and build the confidence that they truly have something before they take the leap. While some businesses genuinely can’t succeed without funding, I think there's a lot of progress that can be made before taking venture capital investment.

Ubiquity Ventures — led by Sunil Nagaraj — is a seed-stage venture capital firm focused on startups solving real-world physical problems with "software beyond the screen", often using smart hardware or machine learning.

If your startup fits this description, fill out the 60-second Ubiquity pitch form and you’ll hear back shortly.